Whether you’re a freelancer, sole trader or business owner, there are many advantages to working for yourself, however, there can also be challenges. Those that are new to business may feel apprehensive when it comes to specific aspects of self-employment, particularly the financial side. Tasks such as taxes, VAT and invoicing can seem complicated at first but with some experience, may not seem as daunting after a while. Speaking of invoicing- what do you need to know about when and how to invoice your clients?

When?

A question that plagues many business owners is when should you invoice? The popular viewpoint is that businesses should invoice their clients as soon as the work is done. This makes sense as the sooner an invoice is sent, the sooner you will be paid and you can therefore stave off potential cash flow problems. Also, you have to consider that many clients will pay their bills in the order that they receive them and if you’re lower on the list, you could face delays.

There is a new approach to invoicing which is becoming more prevalent, particularly with Cloud Services and that’s paying ahead of time. The idea being that you invoice your client and then complete a specific amount of work. Whilst this may seem attractive at first, freeing up capital, it can also become overly complex. For example, what if the service changes or you end up working more hours? Invoices will then have to be adapted, which can be a hassle for all involved.

How?

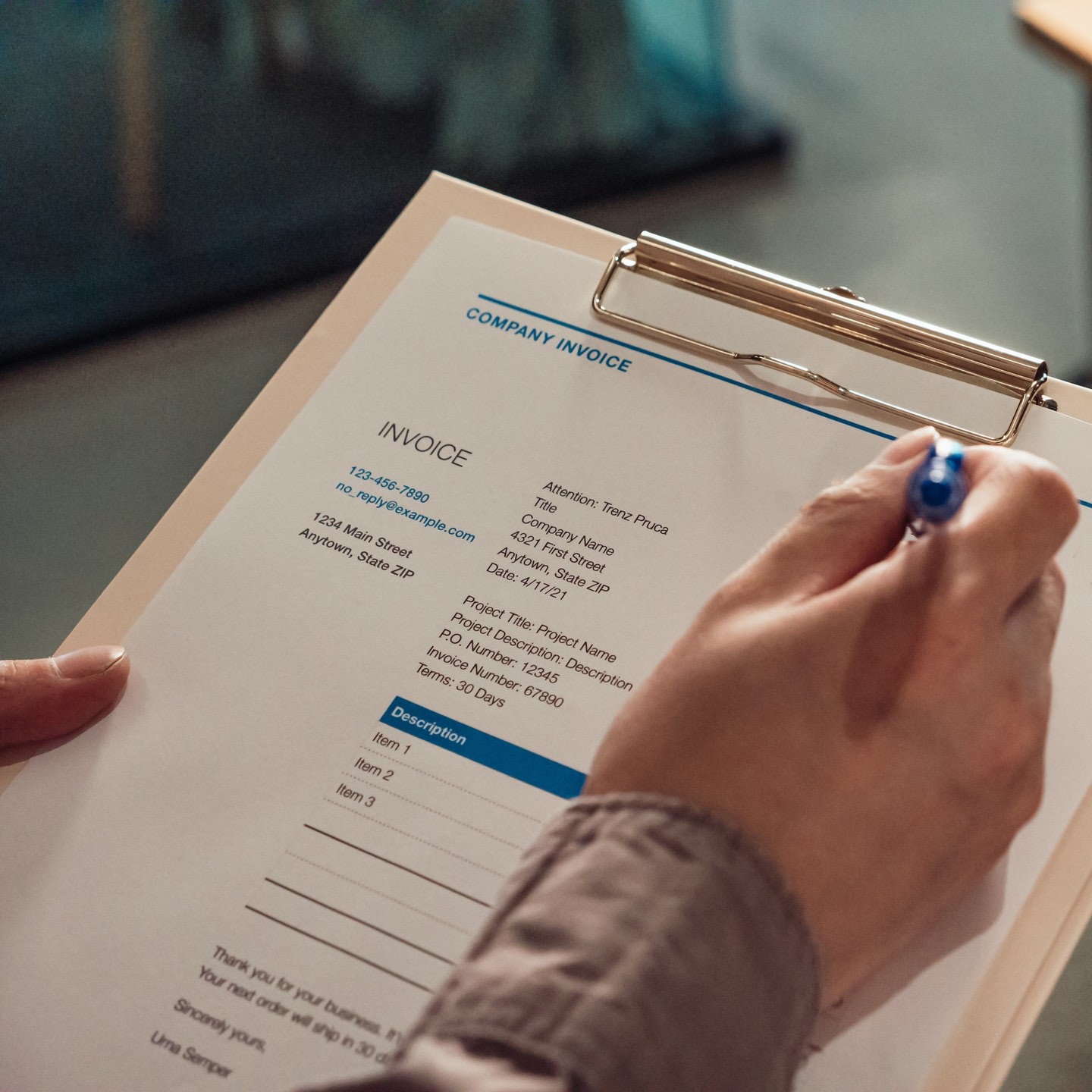

For those that have never created an invoice before, the task can seem complicated. However, there are countless resources available, including templates which allow you to simply add the relevant information. There are specific details, which are legally required on each invoice you send, these include names and addresses of both parties, a unique invoice number, dates and a breakdown of how much you’re charging and what for. If both parties are VAT registered, then a VAT breakdown is also required.

Invoicing can be time consuming, especially if you’re sending out multiple and it’s for this reason that many businesses are now relying on specialist software. These can include in-house software packages or outsourcing this process to a client. The use of specialist software ensures that each of your invoices are completed almost automatically, freeing up valuable time. They can also help in creating documents which look good, with custom logos and structure. Invoices which are generated in this way can help to project an air of professionalism, which can be vital with first time clients.

Organise

It may seem like an obvious suggestion but organising and tracking your invoices is extremely useful. When you’re sending out multiple invoices, it can be easy to let things slip. However, it’s only through tracking and following up on bills, that you can ensure you’re getting paid. It’s for this reason that many business owners incorporate a specific schedule, with all invoices going out on the same day, whether that be weekly, fortnightly, monthly etc. A schedule ensures that you’re keeping on top of the overall process and it makes it easy to spot any issues.

With scheduling in mind, businesses should have some sort of system for late or non-payments. You could even include a clause within your contract and invoice that states that a payment is due within a specific amount of time- otherwise a penalty will be applied. Remember, you want to be firm with your clients but not rude, otherwise you risk alienating customers.

Invoicing can be difficult, whether it’s the documentation itself or the organisational system, but there is help available. The team at Fund Flow can provide expert advice on all aspects of invoicing. Don’t hesitate to get in touch.